inheritance tax calculator colorado

Spouses are automatically exempt from inheritance taxes. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent.

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

The tax rate varies.

. It is sometimes referred to as a death tax Although states may impose their own. The state income tax rate is 45 and the sales. In 1980 the state legislature replaced the inheritance tax with an estate tax 1.

Ad Inheritance and Estate Planning Guidance With Simple Pricing. An estate tax is a tax imposed on the total value of a persons estate at the time of their death. Overall inheritance tax rates vary based on the beneficiarys relationship to the deceased person.

Colorado also has no gift tax. Inheritance tax calculator colorado Friday March 4 2022 Edit. Inheritance tax paid on what you leave.

Ad From Fisher Investments 40 years managing money and helping thousands of families. This entire sum is taxed at the federal estate tax rate which is currently. Individuals can exempt up to 117 million.

Married couples can exempt up to 234. Connecticuts estate tax will have a flat rate of 12 percent by 2023. The good news is that since 1980.

For instance if your taxable estate is 15 million then after the 117 million credit 33 million is taxable. The state of Colorado requires you to pay taxes if youre a resident or nonresident that receives income from a Colorado source. Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance.

Federal Estate Tax Exemptions For 2022. Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law. The gas tax in Colorado is 22 cents per gallon of.

Updated for the 2021-22 tax year. To calculate your inheritance. It is a tax to be paid by a person who inherits money or property or a levy on the estate of a deceased.

Colorado Inheritance Tax and Gift Tax. In 2022 Connecticut estate taxes will range from 116 to 12. Inheritance tax is a tax paid by a beneficiary after receiving inheritance.

There is no federal inheritance tax but there is a federal estate tax. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Many of the people receiving such inheritances often ask if they will have to pay an inheritance tax.

The inheritance tax calculator will tell. For any amount over 12500 but not over. Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021.

For confirmation of how inheritance tax might affect you please seek advice. Spouses in Colorado Inheritance Law. The siblings who inherit will then pay a 11-16 tax rate.

An inheritance is also referred as estate tax in some countries. Information believed to be correct as of 6 April 2022. A state inheritance tax was enacted in Colorado in 1927.

Our free Colorado paycheck calculator can help figure out what your take home. Colorado Capital Gains Tax. Information believed to be correct as of 6 April 2022.

In Iowa siblings will pay a 5 tax on any amount over 0 but not over 12500. State inheritance tax rates range from 1 up to 16. Estimate the value of your estate and how much inheritance tax may be due when you die.

Until 2005 a tax credit was allowed for federal estate. The following are the federal estate tax exemptions for 2022. Surviving spouses are afforded incredibly strong inheritance rights to intestate estates according to Colorado inheritance laws.

Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. State inheritance tax rates range from 1 up to 16. Three cities in Colorado also have a local income tax.

There is no estate or inheritance tax in Colorado. Put in the value of your outstanding mortgage and loans. If the inheritance tax rate is 10 and you inherit 100 you pay 10 in inheritance tax.

Enter the value of any gifts made within the last seven years. First estate taxes are only paid by the. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate.

Others wonder if they will have to pay an estate tax.

Colorado Property Tax Calculator Smartasset

Estate Tax Inheritance Tax In Colorado

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Colorado Property Tax Calculator Smartasset

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

States With No Estate Tax Or Inheritance Tax Plan Where You Die

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

Colorado Estate Tax Everything You Need To Know Smartasset

Taxation In Castle Pines City Of Castle Pines

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

Colorado Estate Tax Everything You Need To Know Smartasset

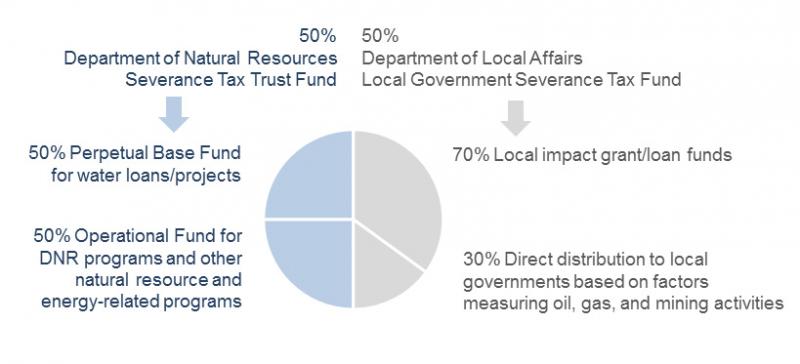

Severance Tax Colorado General Assembly

Individual Income Tax Colorado General Assembly

Colorado Estate Tax Everything You Need To Know Smartasset

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute